When you consider just how big the Canadian business owner market is, Business Insurance is arguably one of the most important components of taking control of a successful Canadian business. However, one pressing question still troubling multiple business owners is: Why is Business Insurance so expensive in Canada? That is exactly what this blog will attempt to explain: the complexities of Business Insurance Costs, providing an in-depth breakdown of how premiums are determined and why getting Business Insurance Quotes is crucial in the grand scheme of financial planning for any business.

Understanding Business Insurance

Perhaps most importantly, Business Insurance serves as protection against unknown risks threatening business operations such as damage to physical property, liability claims, employee-related risks, and the like. This is all-encompassing in scope, thereby highlighting the necessity for Business Insurance Quotes that operate as per each firm’s needs.

The Factors Influencing Business Insurance Cost

Several key determinants go into the cost of Business Insurance in Canada, respectively playing a very influential part in the formula used to calculate the premium.

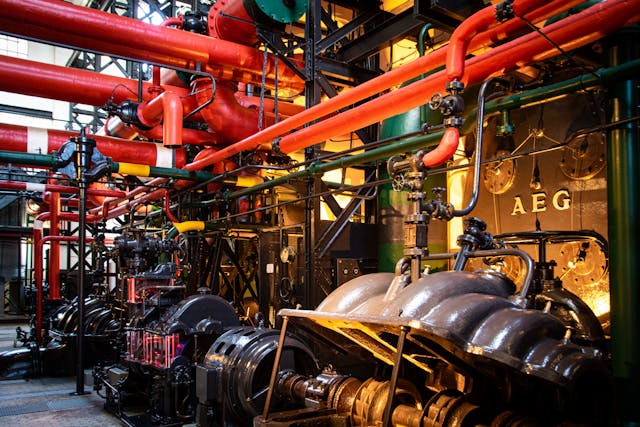

- Industry And Risk Profile: Just as industries are different from the standpoint of operation, each business is diversified in terms of the risks it carries. Industries where accidents or damages are more likely to happen, such as construction or manufacturing, tend to pay more for insurance.

- Business Type and Workload: The overall size of a business and the general workload in which a business carries out various processes can have a huge impact on the price of different insurance products. Big businesses that employ more people, have multiple locations, and large assets—compared to those in high-risk industries—need plans that have more extensive coverage, which means higher premiums.

- Claims History: History has proven that being sued and/or causing damage results in higher premiums (just like with personal insurance!). If a business has a record of putting in claims regularly, the insurance company will understand it to be at increased risk, making the cost of insurance cover higher as a result.

- Coverage Limitations: Straight vs Full for the accounts and Chosen policy limit: How much coverage you obtain and the policy limit impacts Business Insurance Prices. Choosing larger limits for expanded coverage offers more shielding, but also a higher cost.

- Location: Where a business is physically located is a major rating factor for insurance costs. This may result in higher premiums in areas that are more likely to experience natural disasters, live in high crime areas, or are otherwise exposed to localized risks.

Exploring the Cost of Business Insurance

Additionally, factors affecting Business Insurance Costs make it apparent that if you are looking for cheaper premiums for better coverage, you will have to come up with a strategy. This is where multiple Business Insurance Quotes are obtained. With online quotes, small business owners can see for themselves what coverage options are available and what the various deductibles and premium costs are. It helps them find the right balance between cost and protection.

Strategies for Managing Business Insurance Costs

Although Business Insurance can be expensive to purchase, there are many things businesses can do in order to control and possibly minimize the amount of insurance they spend on.

- Risk Management Practices: The use of strong risk management practices can not only decrease the likelihood of claims but also make a business appear at a lower risk to insurers. This may take the form of employee security training, premises security, or the proper maintenance of your equipment.

- Review and Adjust Your Coverage Regularly: Your business grows and your insurance needs will change along with it. Ongoing reviews and adjustments to your coverage not only help keep costs down (since you are not overinsured or underinsured) but could also help you prevent a catastrophe or a lawsuit.

- Higher Deductibles: Choosing a higher deductible can decrease the costs of the premium. At the same time, businesses have to weigh this exposure with the capacity to pay larger out-of-pocket costs if it comes to make a claim.

- Bundle Policies: Insurers often provide discounts for bundling multiple policies, such as property and liability coverage, together in one package.

- Seek Other Offers: When buying Business Insurance, shop different insurance companies to discover what they offer in coverage and premium rates before making a decision.

The Importance of Accurate Business Insurance Quotes

Finding low-cost Business Insurance is important for sound financial planning for any business in Canada. Making sure that you are able to acquire accurate Business Insurance Quotes is integral to this process and one that should be completed with thoroughness and knowledge of your business’s unique needs and risks. The process of ensuring the accurate coverage secured for the most competitive price is what makes the journey to the quote successful.

Delving into the Details: The Backbone of Accurate Quotes

A realistic Business Insurance Quote will always take into account every detail about your business. At the heart of your income protection insurance quote is usually the general information you give to your chosen insurance provider. For this reason, companies need to supply detailed information about the way they do business so insurers can consider all the scenarios surrounding any potential claim when calculating the premium. This includes basic data like company size, employee numbers, and industry sector, as well as more fine-grained information. Discretionary information such as daily operations, employee roles, and the location or value of assets can all affect how risk might be assessed and, in turn, the quote you are offered.

In addition, the details of a business’s risk management practices are central to getting accurate quotes. Risk management can help prevent loss, but it can also let insurers know that you are taking an active role in avoiding and reducing risk. Showing that your business has extensive safety measures in place, disaster preparedness protocols, and even employee training can be a plus in getting an insurance quote. That level of specificity will not only encourage more accurate quotes but could reduce the associated costs and overall premiums.

Engaging with Expertise: The Role of Insurance Brokers

That is particularly the case when it comes to Business Insurance, and many businesses that are not already well-versed in policy options and their implications can be complex to navigate. This is where insurance brokers are your best friends. Business Insurance: brokers intimately know the insurance market, what types of Business Insurance policies are on offer and who the best insurers are for different industries and risk levels. Working with an insurance broker provides you with several advantages, none more important than their ability to properly interpret the complex information about your business into insurance language that works for you. Not only do they know what information needs to be collected, but they can also help the business present the information to the insurers in a way that reflects the business and the risks it presents. Expert mediation also ultimately guarantees that you get competitive prices – as well as prices that are actually reflective of the coverage you need.

The Impact of Accurate Quotes on Business Insurance Costs

Moreover, the importance of the procurement itself is further expanded by obtaining appropriate Business Insurance Quotes. Not only are you uncovering what appears to be reasonable prices, but you could also discover more via the process. This data is the cornerstone of sound financial planning, enabling businesses to allocate the right funds for insurance expenses while sidestepping the risks underinsurance or overinsurance can impose. They offer a straightforward comparison of coverage options so that businesses can understand what levels of protection they require and the costs they can bear. In addition, precise quotes might bring about financial savings down the road. Businesses that do not tailor their coverage to their specific risks may mistakenly overpay for coverage or end up with coverage gaps they had not anticipated. This alignment of coverage to risk not only reduces insurance spend but also reinforces organizational recovery in the face of any potential losses.

Final Thoughts

So the question of why Business Insurance costs so much in Canada is a loaded one, as it all boils down to the unique risks and needs faced by each business. Keep the various factors that impact the cost of insurance in mind, and take steps toward managing these costs for your business. Getting all-encompassing Business Insurance Quotes isn’t just one step to protecting your insurance from value; it is also a clever move in financial planning to keep the company continuously conducive to setups. Insurance costs are somewhat counterintuitively relatively low-overhead hedge against changes in the business environment that your company will have to weather over the long term to survive and flourish.