Tax day is a day of reckoning. Income is tallied, and refunds are issued as companies come to terms with their past year’s financial activity.

What many don’t consider is that the end of tax season is the perfect time of year to think about the future. Sure, once the dust settles, it’s tempting to put taxes out of sight and out of mind for a few months.

But the truth is, now is the best time to smooth the way for next year’s tax activity. With that in mind, here are a few tips and suggestions for different ways to use the present to make quarterly business taxes easier next year.

1. Outsource Your Finances

The first question, before you crunch any numbers or look at any dates, is if you should be doing your quarterly taxes in the first place. Look at the year ahead and consider if you can still reasonably handle your business’s taxes.

If you can’t, it may be time to pass things off to a third-party provider. If you’re a solopreneur, this might mean finding a competent CPA who you can collaborate with and to whom you can ask questions.

If you’re in a growing company, it might be time to hire a CPA on staff. There are also accountants who work on a freelance basis if you’re not ready for a full-time salaried employee.

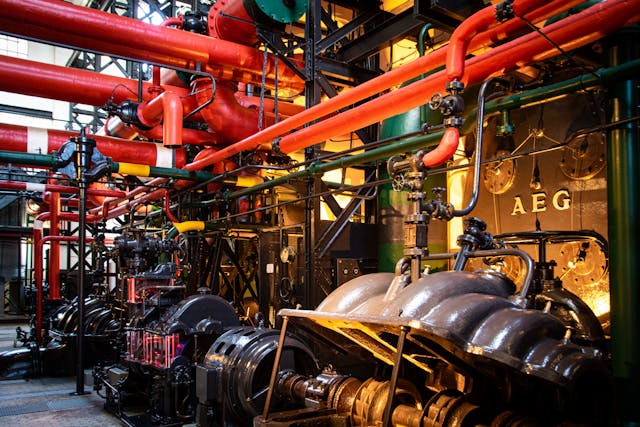

Even if you’re in a startup, outsourcing is an option. AquiferCFO, for instance, is a plug-in finance department solution offering multi-industry startup support. The brand integrates into each company, helping with the day-to-day financials and providing industry insights and improvement options for busy startup teams.

Whatever your circumstances might be, if you feel like it’s time to pass off your finances, now is a good time to do it.

2. Look for the Lessons From Last Year

If you choose to keep handling your taxes yourself, then it’s time to look for ways to internally take things to the next level. Take a good hard look back over the past year.

What lessons can you learn? What went well with your taxes? What went poorly? Were you late, or did you miss payments? Did you under or overpay?

Taxes are a yearly affair. Even quarterly taxes only happen once every few months. It’s easy to forget things along the way. Use the current tax season as a way to identify areas for growth and then implement them moving forward.

3. Calibrate How Much You’re Paying Each Quarter

The most obvious area of adjustment is the dollar figure that you’re electronically handing over to Uncle Sam every few months. Did you find that you paid too much, too little, or just the right amount in 2022? Use your answer to inform how much you should pay this year, too.

Don’t stop there, either. Take a look at your financial forecasts. Will you grow this year? Will you have new expenses that you’re already aware of? How will this impact your quarterly taxes?

For self-employed individuals who are more or less on their own, TurboTax has a nifty resource outlining many of the things to be aware of while calculating your taxes each quarter.

4. Organize Your Quarterly Tax Paying Process

If you’re this far into a resource on making quarterly taxes easier, there’s a chance your current system is a bit disorganized. It’s understandable, as most of the quarterly payment process involves vague numbers and digital software. But digital clutter is a thing, too, and there are ways to fix it.

For instance, if your quarterly tax-paying process is stressful, start by recording the basic steps involved. Create a document in a safe space (i.e., on a secure computer or even on a physical piece of paper) where you can record relatively detailed instructions. Write down the websites you need to visit, your account info, and the steps that you need to take once you’re logged in.

You can also often save certain payment information to a quarterly tax platform. That can make it much easier to log in and quickly make a payment in a few months.

5. Put the Dates in the Calendar

Finally, one of the simplest ways you can streamline your quarterly tax payments this year is by putting the dates each payment is due into your calendar. The IRS has this information on its website. For convenience’s sake, here are 2023’s dates:

- June 15th

- September 15th

- January 15th (2024)

Whatever you use to track your data-driven responsibilities, put these dates in there. Then, add a reminder a week or two before. That way, you’ll have plenty of warning before each payment is due.

Quarterly taxes are a pain to take care of, especially when you’re trying to focus on running your business. However, they don’t need to be more complicated simply because you handle them in a disorganized or overly-complicated manner. Use the current tax season to pave the way for a better future, one where your payments are well-calculated and on time, and where you can be cool, calm, and collected.