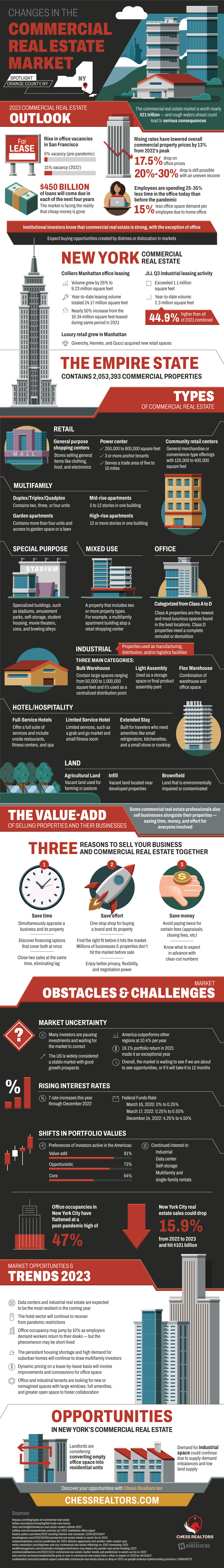

The commercial real estate market is currently valued at almost $21 trillion, but there are some major changes in the market that could affect this projection. The pandemic has led to a rise in office vacancies in San Francisco, with prices dropping by 13% from 2022. The decreased demand for office space due to remote working has created a 15% less demand per employee. Furthermore, $450 billion of loans are due in each of the next four years, so the market is now facing the reality that cheap money is gone.

Additional factors that are impacting the commercial real estate market include market uncertainty, rising interest rates, inflation, and shifting investment priorities. The market is waiting to see if there will be opportunities. For example, in New York, Manhattan office leasing has increased significantly. The luxury retail sector has also grown in Manhattan.

Data centers and industrial real estate are expected to be the most resilient in the coming year. The hotel sector will continue to recover from pandemic restrictions, and office occupancy may jump by 10% as employers demand workers return to their desks. In conclusion, many of the impacts on the commercial real estate market that have been influenced by the pandemic are expected to lessen in the next few years.

Source: ChessRealtors.com