If it seems like watching a lot more television since the COVID-19 pandemic hit the country, you’re likely not alone. With restrictions on what we are able to do and where we can go, TV is one of the best options to keep ourselves entertained…Myself included.

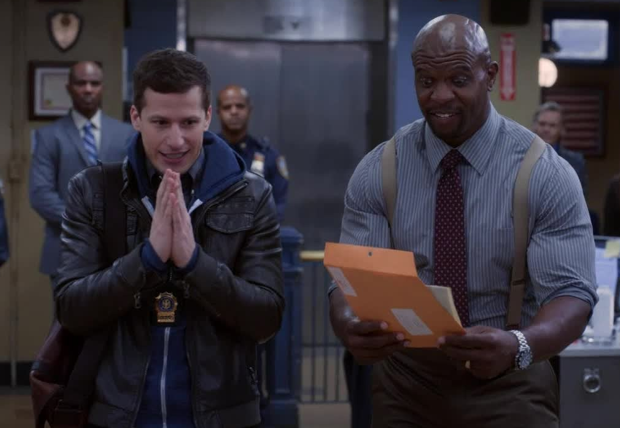

Last week I was watching an older series, Brooklyn 99, which is an acclaimed television comedy that follows goofy detective Jake Peralta (played by Adam Sandberg), who always seems to get great results while having fun on the job.

In one episode, Jake struts around the precinct, boasting about an inheritance from his rich uncle, the contents of which are inside a single envelope. Jake is so nervous to see what’s inside, he has a colleague open the envelope, revealing he has received 1 million shares of stock.

The crowd awes with excitement!

However, soon after, it’s revealed that it was actually 1 million shares of Blockbuster stock, which is now worthless.

It got laughs because no one in their right mind would hold a company that was surely on its way to bankruptcy… Or would they?

I see a lot of parallels with what happened to detective Jake Peralta and his uncle’s Blockbuster stock and what is happening in the retail space today.

Blockbuster was taken out by the very company that tried to partner with them, Netflix. As the story goes, Netflix founder Reed Hastings was laughed out of the room by Blockbuster management when he proposed a partnership.

This got me thinking, I just read a recent article on Bloomberg titled, “Amateur J.C. Penney Traders Beg Judge to Save Them From Wipeout.”

Is it possible that an investor bought into JCPenney’s thinking it was going to have a rebound?

When evaluating chart patterns, every stock goes through periods of peaks and troughs, but there comes a time when every investor should understand if a company is getting disrupted and if they need to exit stage left.

Disruption happens when an innovation and value network displaces an established value network, causing people to adapt to a new product or a new way of doing things.

In the case of Blockbuster, driving to a brick-and-mortar location to pick up a movie and then having the responsibility to bring it back one day later or be hit with late fees was certainly not going to be missed. Netflix movies by mail model and later streaming services would destroy all of Blockbuster’s value, forcing it into bankruptcy.

The same thing is happening to JCPenney’s today. Anyone who thought JCPenney’s might have another rebound wasn’t paying attention to what’s happening in retail or to what history has told us about disruption.

Some people may have thought the displaced company was poised for a rebound. Or perhaps they thought JCPenney’s would be a prime target for a possible merger. What these amateur investors did not know is that they were setting themselves up for failure right from the start.

There is certainly no shortage of investors willing to take risks in the market, but this was one that never should have been made. It’s all about who gets paid first when a company files bankruptcy.

Stock traders are playing with fire when they buy bankrupt companies, as the shareholders are usually the last to collect any money. First bondholders and other creditors get paid, then if there’s any money left over, it goes to the stockholders.

Often these debt holders don’t recoup all their money, absorbing every cent available within the company, leaving stockholders left with nothing.

This is why detective Jake Peralta had 1 million shares of worthless stock, and why amateur traders looking to get rich on JCPenney’s made a fatal error. It’s foolish to buy these types of companies while the country is in lockdown from a pandemic, only escalating the demise of brick-and-mortar retail locations.

I never recommend playing the get rich quick strategy, but if you are going to play it, at least pick a strategy that gives you the best opportunity to win.

Smart, researched, and calculated investing is going to outperform every other strategy over the long run. There still an endless amount of great opportunity in today’s market. For those who want to take advantage of it, I highly recommend you jump into the right opportunity matched with the smartest options trading strategy so that you can set yourself up for long-term success.