It makes no difference if your business is dominating the industry, is a powerhouse, or is just getting started. Cash is crucial and cash flow is one of the most critical components of any business.

No matter how well or poorly your sales perform, if enough cash doesn’t flow across the company, it will inevitably fail. Even if profits are high, if something goes wrong and the company accumulates bad debts or experiences a few months of late invoicing, it might send the business into a downward spiral where it struggles to stay afloat. Fortunately, there are steps that can be taken to get firms ready for cash flow as well as strategies for dealing with issues as they arise.

How do you spot the problems that harm cash flow?

Problems with cash flow typically result from a lack of planning, most of the time. Making a cash flow prediction is an important step in a company’s planning process, but it must be done meticulously. All prospective incomings and outgoings, as well as any potential long-term implications of paying loans and quarterly or yearly tax obligations, must be included in a forecast. How much time will it take to repay long-term loans? Businesses must also consider seasonal changes and if they can generate enough revenue to endure lean periods.

Some companies are just plain unfortunate. Late payments from customers, which leave businesses shorthanded, or a piece of equipment breaking down unexpectedly could be to blame. When it comes to unpaid invoices, it slows down the entire operation of the business. A business will find it difficult to stay afloat even with a lot of sales pouring in if the money doesn’t follow right away.

Efficiency with your incomings and outgoings

Although a business’s cash flow needs to be planned for and updated on a regular basis, there are several effective techniques to maximise incoming and departing funds. On the surface of things, it seems simple to control the flow of money into and out of the company. It’s actually a lot more difficult than it appears to be.

So, what are some of the best practises for managing incoming and exiting cash effectively?

- Make sure you conduct background checks on your clients, paying particular attention to their credit histories.

- Be firm when dealing with customers, and if required, follow up with any who make late payments.

- Make it standard practise for your company to accept advance deposits from clients rather than complete payments.

- Utilise the company’s own terms for departing payments to the fullest extent. Pay on the final day of a 30-day contract if it helps you manage your cash flow a little bit better.

- If your company has dependable suppliers but is having trouble with cash flow, make sure to let them know and try to arrange a later payment date.

The first step is to run a credit check on each client. You can use this to determine whether they are worthwhile to trade with in the first place. A credit check is quite simple to perform and will just provide a general assessment of the applicant’s payment history. Be firm and demand what you are owed if a client continues to pay late despite having stellar credit. This doesn’t entail being unduly pushy; it just means sending out an email requesting payment.

The sooner cash enters the company, the better. This is why deposits can be very significant and advantageous. Outgoing payments are made easier the faster money is received. Businesses may be reluctant to make a down payment at first, but if they can divide their payments into smaller sums, it can be simpler in the long run.

It’s crucial to exercise financial intelligence when it comes to outgoings within the company. Use the option of long payback terms if it is advantageous to do so. Determine the day that will benefit the company the most and ease cash flow rather than paying right now. If the company is already facing issues, the best place to look will be at formal repayment plans, these help business get their finances back on track and whilst also allowing you to keep trading.

In summary

Cash will always be king. Unless it’s flowing effectively throughout your business making things work gets harder and harder. Keeping track of your cashflow will be one of the best things you can do, in terms of keeping things in track and could be the key to a business avoiding liquidation.

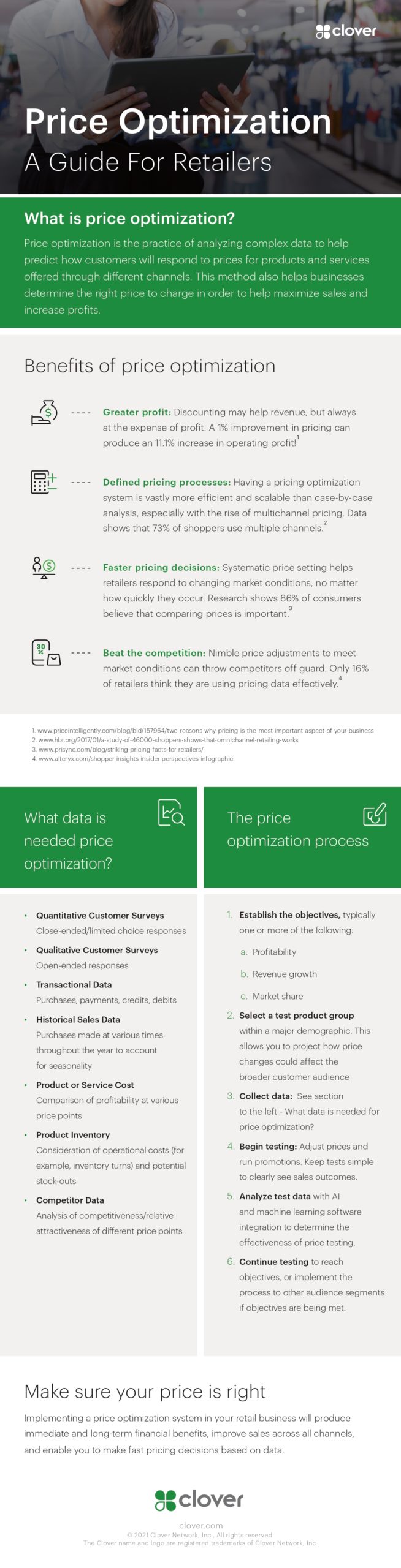

Infographic created by Clover, a POS system provider